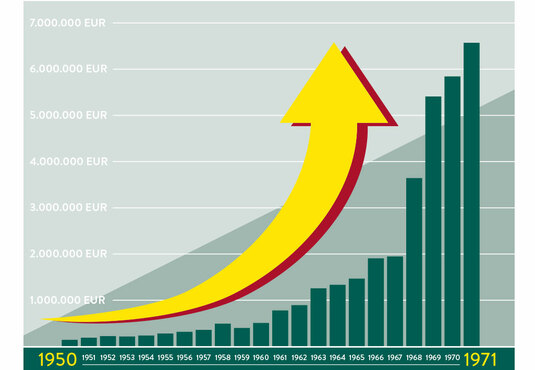

Bankruptcy?

"They're going to call in our loans!" Franz Rauch had to announce this at a management meeting in spring 1966. Trudi, Erich and Roman were probably speechless for a moment. The Rauch family had largely financed the expansion course upon which they had embarked in 1962 with loans from the company's two local banks. There was an outstanding amount of several million schillings. Turnover was growing splendidly, but profits were still modest. Although the banks were aware of the ambitious plans of the young management team, they no longer believed they would succeed. Bankruptcy?

Franz Rauch remembers the toughest days of his life: "I got an appointment with Heinrich Treichl, Managing Director of Creditanstalt in Vienna, via an acquaintance." On a Sunday evening he took a seat in a 6-berth couchette compartment of the "Wiener Walzer", the night train to the capital. On Monday morning he presented the Rauch strategy to the CA management board in 30 minutes. "Treichl nodded and told me to come back in two hours. I waited in a café. Then he handed me two cheques and a letter to our company banks in which CA explained the purchase of our loans."

On Monday afternoon, Franz Rauch rode back home by train. "Our village banks hadn't expected Austria's largest bank to trust us," recalls Rauch. The four young Rauchs pledged every square metre of land to CA as collateral. "We all believed in our concept and so it was easy for us to sign the mortgage certificate," recalls Trudi Ludescher.

Franz Rauch rode to his appointment with the managing board of Creditanstalt in a 6-berth couchette car of the legendary night train "Wiener Walzer": Austria's largest bank rescues the company.